Business Mobile FX

When planning FX (foreign exchange) payments, businesses should consider the following key factors:

Exchange Rates

Businesses should regularly monitor exchange rates and choose the most favourable rate for their transaction.

Fees

Businesses should be aware of the fees charged by banks and other payment providers, as they can significantly impact the cost of FX payments.

Payment Methods

Businesses should choose the most appropriate payment method for their needs, whether it’s a wire transfer, electronic payment, or physical cheque.

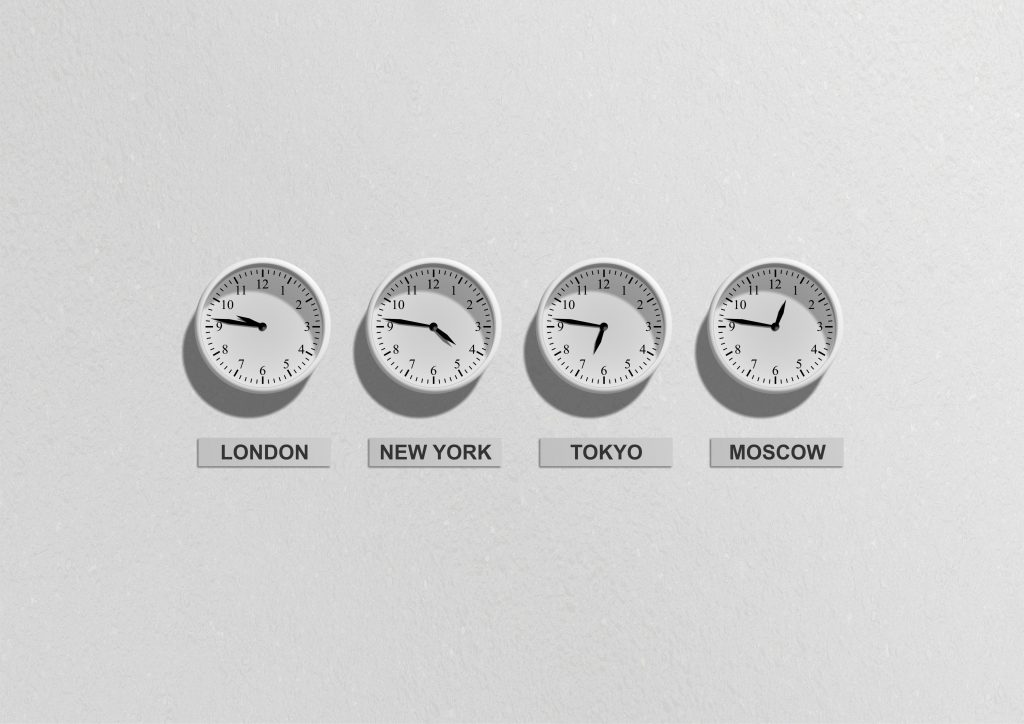

Timing

Timing is crucial when making FX payments, as exchange rates can fluctuate quickly. Businesses should plan ahead and make payments at the right time to get the best exchange rate.

Regulation

Small businesses should also be aware of any regulations that apply to FX payments in the countries they are making payments to or from.

There are several types of mobile foreign exchange (FX) for businesses:

Mobile Currency Conversion: These FX tools allow businesses to convert one currency to another using their mobile devices.

Mobile Foreign Exchange Trading: These FX tools allow businesses to trade currencies using their mobile devices.

Mobile International Money Transfer: These FX tools allow businesses to send and receive payments in different currencies using their mobile devices.

Mobile Forex Alerts: These FX tools allow businesses to receive notifications on currency rate changes and fluctuations using their mobile devices.

Mobile FX Hedging: These FX tools allow businesses to manage their exposure to currency risk by hedging their foreign currency transactions using their mobile devices.

Mobile FX Payment Processing: These FX tools allow businesses to process foreign currency payments using their mobile devices.

Mobile FX Risk Management: These FX tools allow businesses to manage their foreign exchange risk by monitoring currency markets and taking appropriate action using their mobile devices.